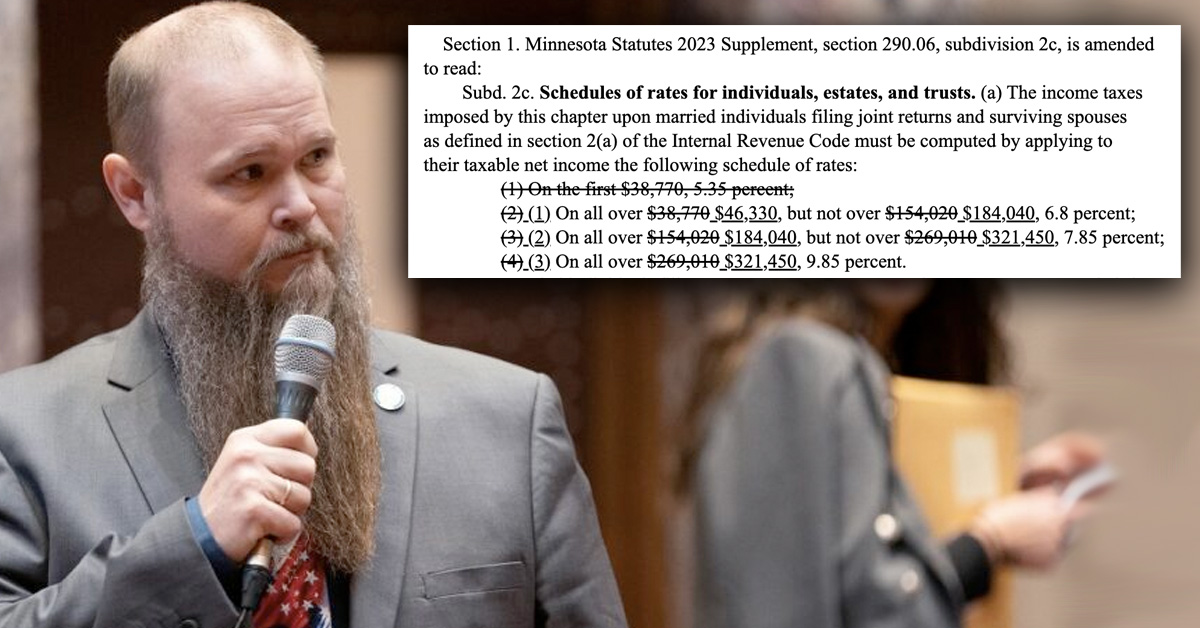

A bill authored by Sen Nathan Wesenberg (R-Little Falls) would completely eliminate the bottom tax tier and rate in Minnesota, and increase the threshold for the next tier, saving Minnesotans who make over $46,000 of Adjusted Gross Income (couples filing jointly) nearly $2,500.

Usually tax cut bills stand little chance of passage when Democrats and RINOs are in charge, but Wesenberg’s bill already has a Democrat co-author, Sen John Hoffman (DFL-Champlin). According to Wesenberg, the Senate’s Tax Chair, Sen Ann Rest, is willing to hear bills in the tax committee that have bipartisan support.

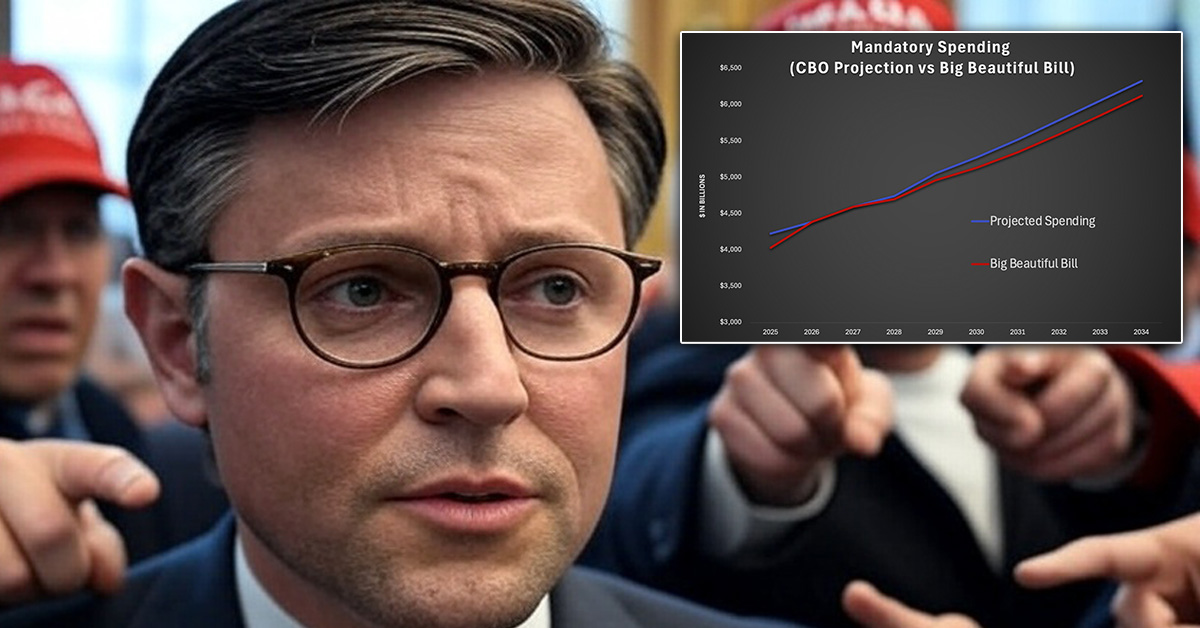

If passed, $6 Billion would stay in the hands of hard working families in Minnesota and not spent on wasteful government projects. Minnesota Management and Budget will be releasing it’s February Economic Forecast tomorrow which is predicted to show a surplus of $5-6 Billion when including the reserve funds that were taxed and are sitting in a government account.

Wesenberg’s bill (SF4264) is short and simple. Here’s what it does: