Washington’s reckless spending continues. The United States surpassed the $34 Trillion mark for the first time in history, which equates to $264,000 per taxpayer. And there’s no end in sight on this dangerous course politicians are taking. The federal budget is on pace to add another $1.7 Trillion in debt this year.

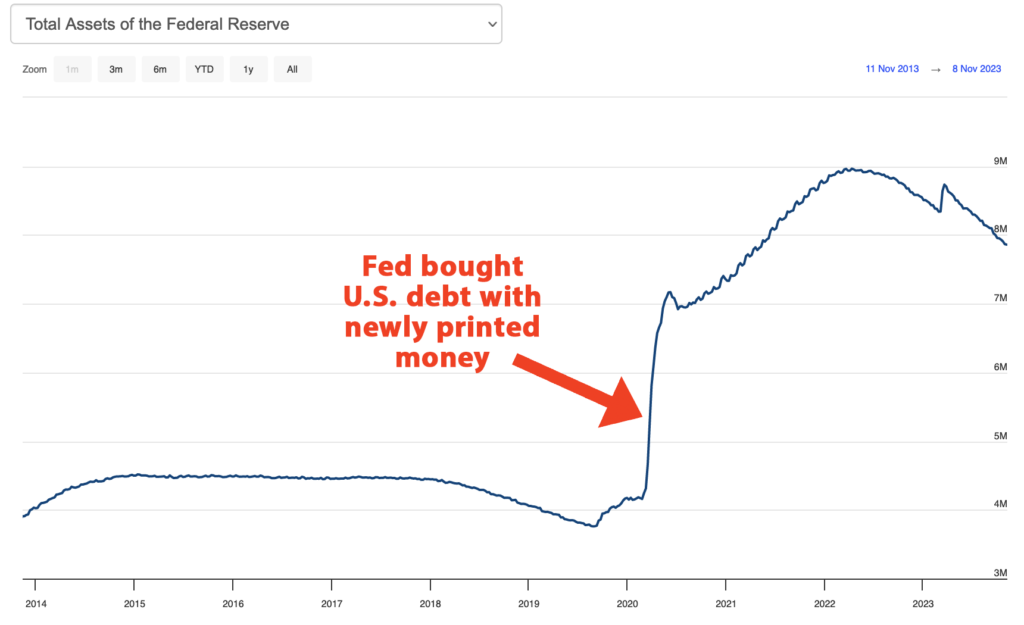

Most concerning about the debt is the fact that a growing portion of it is financed through a money printing scheme by the Federal Reserve Bank, called Quantitative Easing. This is the process where the Federal Reserve creates money out of thin air to buy up the U.S. Treasuries to fund politicians’ reckless spending. That money creation is why consumer prices have risen so much in the last couple years.

If politicians don’t reverse course soon, rising interest rates on U.S. debt will make annual interest payments consume too much of the federal budget. Currently, interest payments are already larger than the entire military budget.